Introduction to Online Trading for Beginners

Embarking on a journey into online trading can be both exciting and overwhelming for newcomers. The digital age has democratized access to financial markets, allowing individuals to trade stocks, forex, cryptocurrencies, and more from the comfort of their homes. However, understanding the fundamentals, developing sound strategies, and choosing the right platforms are crucial steps toward trading success. Whether aiming to generate additional income or build long-term wealth, beginners need a structured approach to navigate the complexities of online trading effectively.

For an in-depth exploration of starting your trading journey, visit Online Trading for Beginners, a resource designed to guide aspiring traders through every stage of their development with actionable insights and expert advice.

Understanding the Basics of Stock and Forex Trading

Digital trading encompasses various markets, with stock and forex trading being among the most popular for beginners. Stock trading involves buying and selling shares of publicly traded companies, aiming to profit from price appreciation or dividends. Forex trading, on the other hand, deals with currency pairs, where traders speculate on the strength of one currency against another.

In stock trading, participants analyze company fundamentals, market trends, and economic indicators to make informed decisions. Forex trading emphasizes technical analysis, leveraging charts and patterns, due to its high liquidity and 24-hour availability. Understanding these foundational concepts is essential, as they inform your decision-making process and risk management techniques.

Differences Between Trading and Investing

While often used interchangeably, trading and investing are distinct strategies with different goals and timeframes. Investing typically involves holding assets over months or years, focusing on long-term growth, dividends, and compounding. It’s characterized by a buy-and-hold mentality, emphasizing fundamental analysis and patience.

Trading, especially online trading for beginners, aims for short-term profits through frequent buying and selling. Traders leverage technical analysis, market volatility, and timing to capitalize on price swings within minutes, hours, or days. This active approach demands discipline, swift decision-making, and robust risk management to navigate rapid market fluctuations effectively.

Common Challenges Faced by New Traders

Starting out, many traders encounter obstacles such as emotional decision-making, insufficient knowledge, and unrealistic expectations. The fear of loss can lead to hesitation, while greed might prompt overtrading. Lack of a clear strategy and discipline often results in inconsistent performance.

Additionally, beginners tend to underestimate transaction costs, overleverage their accounts, or neglect proper risk management. To mitigate these challenges, it’s crucial to educate oneself continuously, develop a solid trading plan, and employ disciplined trading habits rooted in thorough analysis and risk control techniques.

Choosing the Right Trading Platform and Broker

Selecting a reliable and user-friendly platform is fundamental for a successful trading experience. The right broker provides not only the necessary tools and features but also ensures regulatory compliance, transparency, and customer support.

Key Features to Look for in Beginner-Friendly Platforms

- Intuitive interface with easy navigation

- Comprehensive educational resources and tutorials

- Demo accounts for practice without risking real money

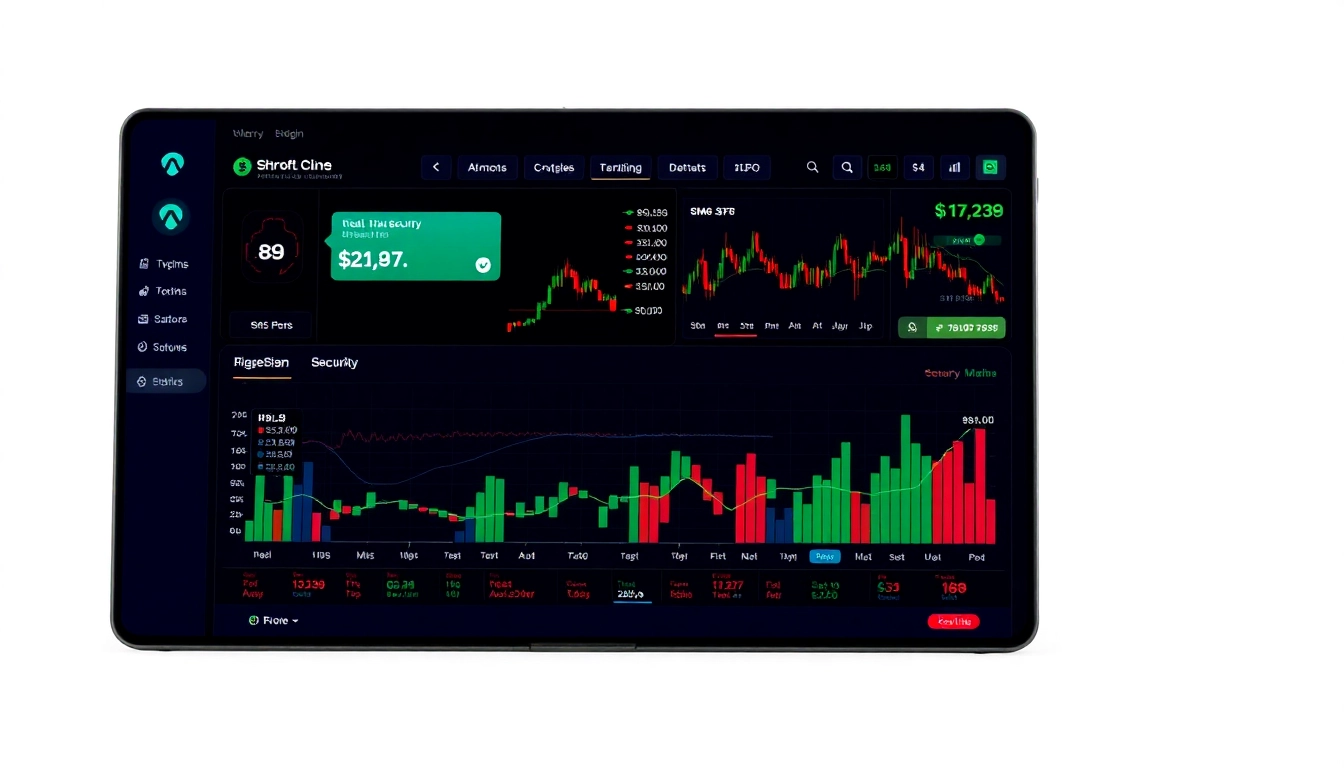

- Real-time charts and technical analysis tools

- Affordable transaction costs and spreads

- Responsive customer support and reliable order execution

Top Online Brokers for Beginners in 2025

Based on recent reviews and industry standards, top brokers include Fidelity, Charles Schwab, Robinhood, M1 Finance, and eToro. These platforms are renowned for their ease of use, educational content, and regulatory oversight. For example, Fidelity offers robust research tools and a variety of account options suitable for beginners. Robinhood is known for its commission-free trades and sleek mobile app, making it attractive for new traders.

How to Select a Trusted and Regulated Broker

Always verify the broker’s regulation status with authorities like the SEC in the US, FCA in the UK, or ASIC in Australia. A regulated broker guarantees adherence to financial standards, safeguarding your funds and providing dispute resolution mechanisms. Read reviews, compare fees, and test customer support responsiveness before opening an account to ensure a trustworthy partnership.

Developing a Winning Trading Strategy

Fundamental and Technical Analysis Essentials

Effective trading strategies combine understanding fundamental factors—like economic data, earnings reports, and geopolitical events—with technical analysis, which studies price charts, patterns, and indicators. Fundamental analysis helps in long-term decision making, especially in stock trading, while technical analysis is vital for timing entry and exit points in short-term trades.

Tools such as moving averages, RSI, MACD, and candlestick patterns facilitate technical decision-making. Consistent learning and back-testing your strategies using historical data can enhance your confidence and adaptability.

Creating a Personal Trading Plan

A comprehensive trading plan should define your risk tolerance, preferred markets, trading hours, and specific entry and exit criteria. Establishing clear rules minimizes impulsive decisions. For example, setting a maximum daily loss limit protects your capital and prevents emotional trading. Regularly reviewing and adjusting your plan based on performance and market changes is essential for ongoing growth.

Risk Management Techniques for Beginners

Using stop-loss and take-profit orders is fundamental to managing risk. Never risk more than 1-2% of your trading capital on a single trade. Diversification and position sizing further help in mitigating potential losses. Adopting these practices fosters disciplined trading, essential for weathering volatile markets and preserving your capital over the long term.

Practical Steps to Start Trading Live

Opening and Funding Your Trading Account

The initial step involves selecting your broker, completing registration, and verifying your identity. Funding your account typically involves bank transfers, electronic wallets, or other payment methods. Start with a modest amount that aligns with your risk appetite, and consider using demo accounts first to hone your skills.

Placing Your First Trades and Orders

Begin by practicing basic order types—market orders for immediate execution, limit orders for specific entry points, and stop-loss orders for limiting potential losses. Keep trades small and align them with your predefined strategy. Utilizing demo mode can help you familiarize yourself with execution processes without risking real funds.

Monitoring Performance and Adjusting Strategies

Track your trades systematically, reviewing wins and losses to identify patterns and areas for improvement. Use trading journals or analytics tools to analyze your decision-making process. As you gain experience, refine your strategies, and adapt to changing market conditions to enhance your profitability.

Learning and Improving Continuous Trading Skills

Utilizing Educational Resources and Courses

A wealth of online resources, webinars, and courses are available for beginners to deepen their understanding of trading concepts. Websites like Fidelity and IG offer free tutorials on technical analysis, trading psychology, and risk management. Enrolling in structured courses accelerates learning and builds confidence.

Analyzing Trades and Learning from Mistakes

Reviewing your trade history helps you recognize strengths and identify recurring errors. Distinguish between losses due to market volatility and those caused by flawed analysis or emotional decisions. Maintaining a trading journal is an effective method to track progress and inform strategic adjustments.

Staying Updated with Market Trends and News

Financial markets are influenced by macroeconomic events, geopolitical developments, and policy changes. Regularly following reputable news outlets, economic calendars, and market analyses enables traders to anticipate market movements and make timely decisions. Developing this habit is vital for staying ahead in competitive markets.