Understanding the UK Investment Landscape in 2024

In the ever-evolving world of finance, UK investors seek reliable strategies to grow their wealth amidst global uncertainties. The last few months have showcased a resilient market environment, with European stocks maintaining stability after impressive gains by Chinese indices, as well as global shifts in commodities and currencies. For those aiming to navigate this complex terrain effectively, consulting a comprehensive Investment Guide UK can provide invaluable insights into current trends, risk management, and strategic asset allocation tailored specifically for the UK market.

Key Investment Types Available to UK Residents

The UK offers a diverse portfolio of investment options suited to different risk appetites and financial goals. Traditional asset classes include stocks, bonds, and real estate, while alternative investments such as commodities, venture capital, and even emerging sectors like cannabis legalization and green energy often present unique opportunities.

Equities, especially those listed on the FTSE 100 and FTSE 250, remain a cornerstone for UK investors, offering both dividends and capital growth. Bonds, including government gilts and corporate debt, provide income and stability, particularly appealing during times of market volatility. Real estate investments, whether directly through property ownership or indirectly via REITs, offer long-term appreciation and income streams.

Furthermore, the rise of innovative sectors such as renewable energy and technology startups presents new avenues for growth. For example, significant momentum is seen in sectors aligned with sustainability, driven by policies encouraging cleaner energy and regulatory support, aligning well with the UK’s commitments to climate goals.

The Impact of the UK Economy and Global Trends on Investment Opportunities

The UK economy remains sensitive to both domestic policy decisions and global economic fluctuations. Recent movements, such as the steady performance of European stocks post-Chinese market rallies and fluctuating currency values, directly influence investment returns.

Notably, the US Federal Reserve’s rate cut prospects have bolstered gold prices to over four-month highs, highlighting the importance of commodities in hedging against economic uncertainties. As the dollar remains near five-week lows, UK investors can capitalize on currency adjustments by employing hedging strategies or exploring foreign exchange-linked investments.

Moreover, the ongoing effects of Brexit continue to shape trade policies and market sentiment, impacting sectors such as manufacturing, finance, and trade. Investors need to stay informed about evolving political policies, trade agreements, and regulatory reforms to anticipate shifts that may either enhance or impair asset valuations.

Assessing and Managing Risk in UK Investment Portfolios

Understanding individual risk tolerance is paramount to constructing resilient investments. UK investors should consider various factors, including age, income stability, investment horizon, and financial objectives when establishing their risk profiles.

One effective approach is diversification—spreading investments across asset classes, sectors, and geographic regions to mitigate concentration risks. For example, balancing a portfolio with UK stocks, global equities, bonds, and alternative investments like commodities can reduce exposure to localized economic shocks.

Risk management also involves regular portfolio reviews and rebalancing. Employing tools like performance metrics—such as Sharpe ratios, alpha, and beta—can help assess relative performance and guide strategic adjustments. Expert consultation can aid in crafting tailored risk mitigation strategies aligning with changing market conditions.

Strategies for Developing a Successful Investment Approach in the UK

Setting Clear Financial Goals

Defining specific, measurable, and time-bound objectives serves as the foundation for any successful investment strategy. Whether saving for retirement, a child’s education, or purchasing property, clarity in goals ensures appropriate asset allocation and risk management.

Diversification Techniques

Implementing diversification involves allocating capital across multiple asset classes and sectors. For instance, an investor might combine FTSE-listed stocks with global ETFs, green energy funds, and property REITs to balance growth potential and stability.

Choosing the Right Investment Vehicles

Optimal choices include tax-efficient accounts like ISAs and pensions, which provide significant tax advantages. Using different account types can maximize growth and income, especially when aligning investments with long-term goals. Additionally, considering emerging sectors such as renewable energy or technology can yield higher returns, but with increased risk. Regularly reviewing the suitability of investment vehicles ensures alignment with market conditions and personal circumstances.

Tax Benefits and Regulatory Environment for UK Investors

Understanding ISAs and Pensions

Individual Savings Accounts (ISAs) offer a tax-free environment to grow savings, making them a pivotal tool for UK investors. With a generous annual allowance, ISAs enable investors to shield gains from tax, whether in cash, stocks, or innovative investments like EIS (Enterprise Investment Scheme).

Pensions, particularly defined contribution plans, provide deferred tax benefits and employer contributions, thereby enhancing long-term growth potential. As retirement nears, rebalancing assets within pension schemes to reduce exposure to volatile investments becomes critical.

Tax-efficient Strategies

Maximizing tax benefits involves utilizing allowances and reliefs effectively. For example, investing within an ISA or pension can shield returns from capital gains tax and income tax. Tax planning also involves timing asset sales to minimize liabilities and employing relief schemes for specific sectors or start-ups.

Legal Regulations for Foreign Investors

Foreign investors should be aware of UK regulations concerning property ownership, business investments, and digital assets. Ensuring compliance with anti-money laundering laws and understanding Brexit-related legal frameworks are crucial for smooth operations.

Emerging Trends and Investment Opportunities in the UK

Growth Sectors and Markets

The UK is witnessing burgeoning sectors such as green energy, biotechnology, and fintech. Investments in these areas can capitalize on government incentives, innovation hubs, and expanding consumer demand.

Impact of Political and Currency Fluctuations

Post-Brexit trade adjustments and currency valuations significantly influence sector profitability. For example, a weakened pound boosts exports but raises import costs, affecting manufacturing and consumer goods sectors. Monitoring currency trends helps in timing buy/sell decisions and currency-hedged investments.

Sustainable and Green Investments

Environmental, Social, and Governance (ESG) criteria are increasingly shaping investment decisions. UK investors are progressively favoring green bonds, renewable energy projects, and companies with robust sustainability practices, aligning financial returns with societal benefits.

Monitoring and Adjusting Investment Portfolios Effectively

Performance Metrics and Benchmarking

Regular analysis using metrics such as total return, risk-adjusted return, and benchmark comparisons help measure portfolio success against market standards. Setting realistic benchmarks, like the FTSE 100 or global indices, drives accountability.

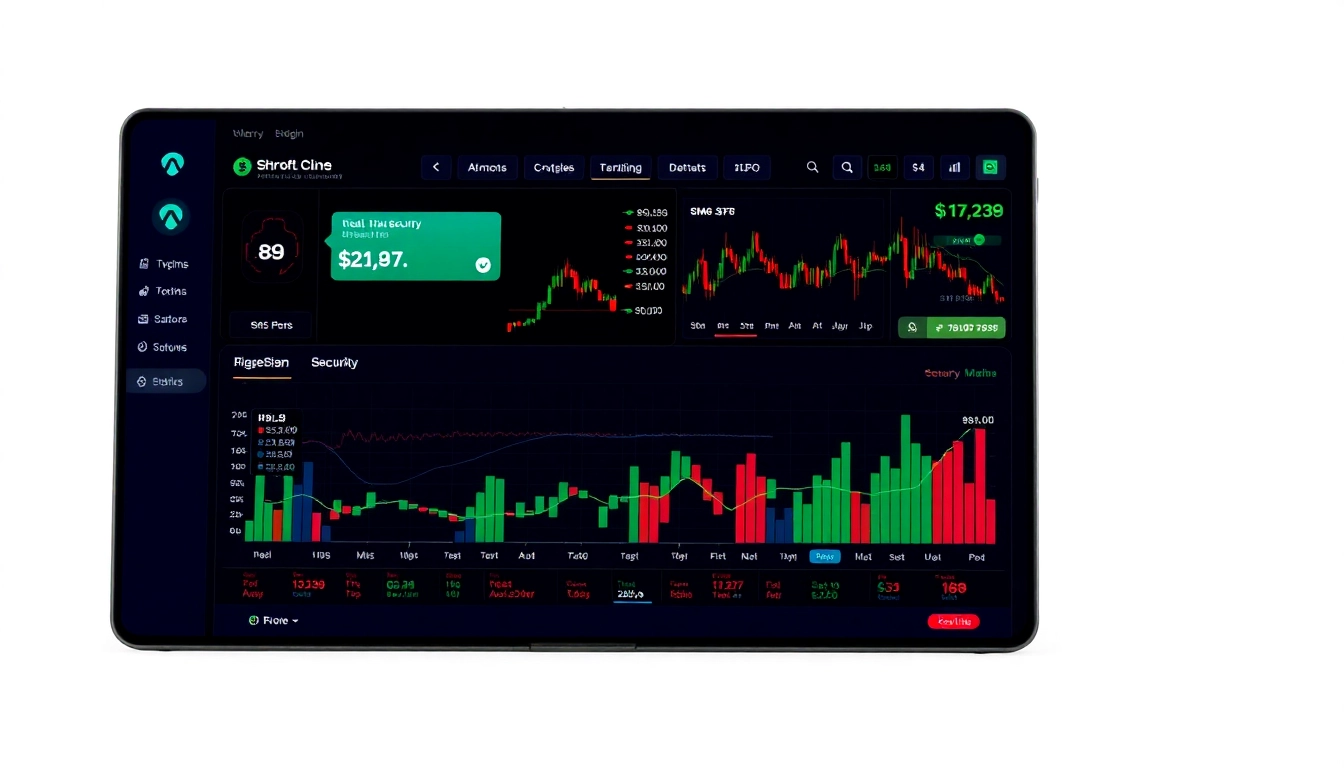

Utilizing Financial Tools

Technology plays a crucial role; investors should leverage financial software, online dashboards, and AI-driven analytics to track performance, manage risks, and identify opportunities swiftly. Automated rebalancing tools can maintain desired asset allocations efficiently.

Rebalancing and Risk Management Techniques

Periodic rebalancing ensures that the portfolio remains aligned with risk tolerance and market conditions. Strategies include threshold rebalancing and cash flow management to capitalize on market dips or rallies, thereby sustaining long-term growth.