Understanding the Current State of UK Commodities Markets

The UK commodities market continues to demonstrate volatility amidst shifting global economic conditions, geopolitical developments, and technological advancements. Recent trends show gold reaching historic highs while oil prices experience fluctuations, reflecting underlying supply and demand dynamics. For investors, staying abreast of these movements is crucial, especially as the backdrop of a mixed stock market landscape influences commodity valuations. To deepen your understanding, explore our comprehensive insights on UK Commodities Investment News, which offers timely updates and analysis tailored for UK-based investors.

Recent Trends in Gold and Oil Prices

Gold has surged past the $3,500 per ounce mark, setting new records driven by inflation concerns, currency fluctuations, and safe-haven demand. This trend underscores gold’s enduring appeal during periods of economic uncertainty. Conversely, oil prices have experienced a dip, with Brent crude futures declining by roughly 0.6% to $68.23 per barrel. Despite the short-term decline, oil is poised for a weekly gain, thanks to ongoing geopolitical tensions, production adjustments by OPEC+, and demand recovery signals from major economies like the US and China.

Such price movements in precious metals and energy commodities highlight the importance of comprehensive market analysis. Investors should consider factors like geopolitical tensions in Eastern Europe and the Middle East, US inventories, and global trade patterns when evaluating oil’s trajectory. Similarly, for gold, inflation indicators, US dollar strength, and central bank policies remain pivotal.

Impact of Global Economic Factors on UK Commodities

Global economic conditions exert a profound influence on UK commodities. The recent economic slowdown in China, reflected by weaker industrial output and iron ore futures slipping, signals potential demand softening for raw materials. Meanwhile, US Federal Reserve rate cut hopes and dollar fluctuations impact commodity prices broadly. For example, a softer dollar tends to boost gold and oil prices, due to cheaper buying power for international buyers.

Furthermore, geopolitical risks, such as Russia’s crude exports and US-China trade negotiations, introduce additional uncertainty. A slowdown in China’s manufacturing sector, coupled with the extension of tariff pauses between the US and China, could modify global demand, affecting UK-based commodity exporters and investors alike. Staying connected with macroeconomic indicators and policy changes is essential for strategic planning.

Analyzing Market Volatility and Risk Management

Market volatility remains a constant challenge for UK commodities investors. Fluctuations driven by macroeconomic data releases, like US inflation figures and employment reports, call for robust risk management strategies. Diversification remains a core principle, spreading exposure across different commodities such as precious metals, energy resources, and industrial metals like copper and iron ore.

Advanced risk mitigation tools, including options, futures, and ETFs, can help investors hedge against unfavorable moves. For example, timing entries and exits based on technical analysis — such as trendline support or resistance — can safeguard against abrupt price shifts. Furthermore, leveraging data analytics and market sentiment indicators enhances decision-making precision, reducing the downside risks during turbulent periods.

Key Factors Influencing Investment in UK Commodities

Geopolitical Developments and Their Market Effects

Geopolitical events play a pivotal role in shaping UK commodities markets. Recent sanctions, conflicts, and diplomatic tensions have driven volatility, especially in energy markets. The Ukraine conflict, for instance, has led to concerns over Russian crude imports and heightened volatility in oil prices globally. Similarly, political decisions in the Middle East influence crude supply and futures pricing.

Investors should monitor geopolitical risk assessments and currency implications, as conflicts can cause sharp swings in commodity valuations. Diversification into more geopolitically resilient assets or commodities with stable supply chains can mitigate such risks effectively.

US-Europe Trade Relations and Commodity Fluctuations

Trade relations between the US and Europe directly impact commodities, especially energy and agricultural products. Ongoing tariff negotiations, trade agreements, and policy shifts influence tariffs, export volumes, and trade flows. As an example, the US-China trade tensions have historically caused price swings in industrial metals like copper and aluminum, which are vital for UK manufacturing sectors.

For UK investors, understanding the nuances of these trade dynamics helps anticipate price movements and adjust portfolios accordingly. Keeping an eye on policy announcements and trade negotiations is vital for timing investments effectively.

Technological Advancements Impacting Commodities Trading

The integration of cutting-edge technology, particularly AI and blockchain, is revolutionizing commodities trading. Meta and other tech giants are exploring partnerships to enhance app functionalities and trading platforms, enabling real-time analytics and more transparent supply chain tracking. These innovations streamline trading processes, improve price discovery, and reduce settlement times.

Furthermore, blockchain’s potential to ensure traceability and combat fraud adds security to commodity transactions, making them more attractive to institutional investors. Investing in technology-driven commodities platforms or adopting advanced analytical tools can provide a competitive edge in this evolving landscape.

Effective Strategies for Investing in UK Commodities

Identifying High-Potential Commodities for 2024

Looking ahead, commodities such as gold, energy products, and critical industrial metals remain promising. Gold’s role as a hedge against inflation and currency devaluation sustains its appeal. Energy commodities, especially oil, are poised for gains as geopolitical tensions persist and supply-demand fundamentals evolve.

Emerging commodities like lithium and nickel are also gaining attention due to electric vehicle adoption and renewable energy needs. Investors should monitor these trends and perform fundamental analyses to identify high-potential assets for 2024.

Diversification Techniques for Stability and Growth

Diversification remains a cornerstone of resilient commodities portfolios. Combining precious metals, energy, agriculture, and industrial metals can buffer against sector-specific downturns. For example, during periods of energy price declines, gold and industrial metals may act as stabilizers.

Utilize structured products, ETFs, and commodity baskets to spread exposure efficiently. Regular rebalancing based on market conditions and macroeconomic data ensures alignment with evolving risk-return expectations.

Utilizing Data and Analytics to Optimize Returns

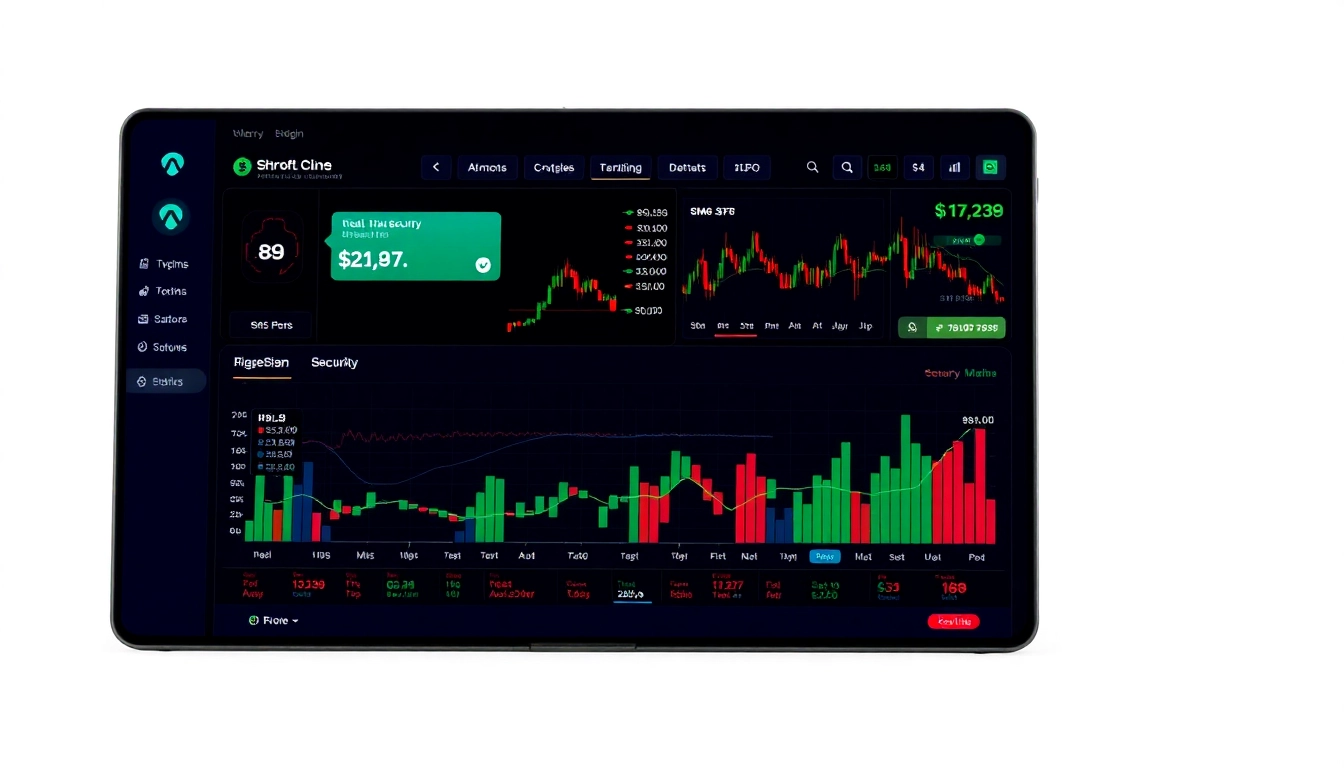

Data-driven decision-making is increasingly vital. Advanced analytics, sentiment analysis, and predictive modeling can forecast price movements more accurately. Employing technical indicators, such as moving averages, trendlines, and oscillators, assists with timely entry and exit points.

Many trading platforms offer AI-powered tools that analyze global news, economic data, and social sentiment to advise trades, thereby enhancing strategic planning and execution.

Regulatory and Policy Environment for UK Commodities Investment

UK Government Policies Affecting Commodities Markets

The UK government’s regulatory stance influences commodities trading profoundly. Policies promoting sustainability, emissions reduction, and renewable energy integration are shaping demand patterns, especially in energy commodities and metals vital for green technologies.

Regulations on derivatives trading, environmental standards, and import-export controls also impact market liquidity and volatility. Keeping abreast of policy shifts helps investors anticipate market implications and navigate compliance requirements effectively.

Taxation, Incentives, and Compliance Considerations

Tax frameworks for commodities, including VAT and capital gains tax, significantly affect net returns. The UK offers incentives for green investments, notably in renewable energy projects, which can indirectly influence commodity sectors.

Compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations is mandatory. Leveraging professional advice and staying aligned with legal standards safeguard investments and ensure market integrity.

Forecasting Regulatory Changes and Market Impact

Regulatory environments are dynamic, with potential future shifts driven by international climate commitments and financial regulations. For example, the EU and UK’s focus on carbon neutrality could impose stricter standards on fossil fuels, influencing prices and investment flows.

Scenario analysis and policy impact studies can prepare investors for upcoming changes, allowing proactive adjustments to portfolios.

Emerging Trends and Future Outlook for UK Commodities

Forecasts for Gold, Oil, and Emerging Commodities

Gold is expected to remain resilient, buoyed by inflationary pressures and geopolitical uncertainties. Oil prices might see continued volatility but generally trend higher as energy transition challenges and geopolitical tensions persist. Emerging commodities like lithium are poised for growth, driven by burgeoning electric vehicle markets and renewable storage needs.

Analysts suggest that technological innovations and policy support for green energy will redefine commodity demand patterns over the next decade.

Digital Transformation and Blockchain in Commodities

The digital revolution is transforming commodities trading. Blockchain-based supply chain tracking ensures transparency and reduces fraud, while digital tokens facilitate international transactions and financing. These changes increase market efficiency, lower costs, and open new investment avenues for both retail and institutional players.

Embracing these trends requires investors to familiarize themselves with new platforms and regulatory considerations around digital assets.

Investor Sentiment and Market Sentiment Indicators

Market sentiment significantly influences commodity prices, often leading to overreactive swings. Sentiment indicators, such as investor surveys, options volume, and social media trends, provide insights into prevailing market psychology.

Coupling sentiment analysis with fundamental data allows for more nuanced investment strategies, particularly in volatile markets, helping investors capitalize on or shield from abrupt price changes.